Understanding the Interplay between Economic Indicators in Forex

Key Takeaways

- The interplay of economic indicators can significantly influence currency values in the Forex market.

- Proactive monitoring of GDP and other economic data releases is crucial for traders.

- Integrating technical analysis with economic indicators optimizes trading strategies.

- Continuous learning and adaptation to market changes is essential for Forex success.

Table of contents

- The Domino Effect of Economic Indicators

- Case Studies of Currency Responses to Economic Indicators

- Stay Ahead with a Proactive Outlook towards Economic Indicators

- Integration of Technical Analysis with Economic Indicators

- Reliable Technical Indicators for Forex Traders

- Practical Tips for Forex Traders in Reading Economic Indicators

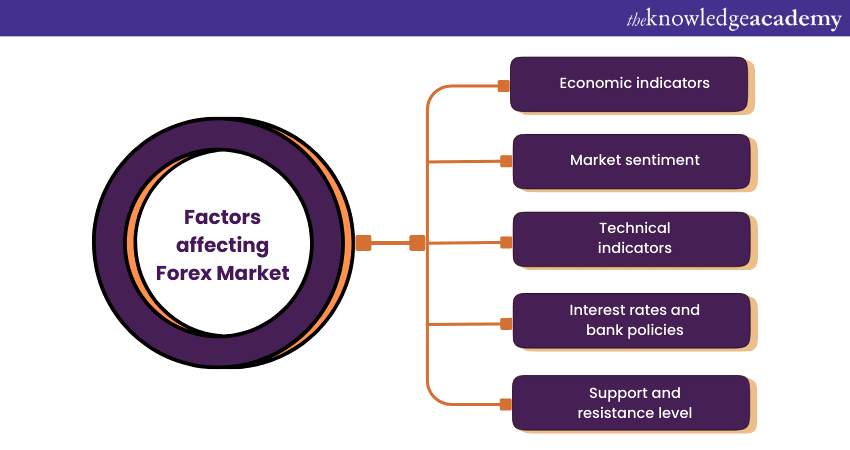

Key economic indicators do not exist in isolation. Their interplay generates ripple effects in the economy, influencing currency values. For example, *rising GDP figures* can boost investor confidence, potentially leading to currency appreciation. However, if inflation is also on the rise, central banks might raise interest rates to curb inflation, consequently impacting currency values. This interconnected dynamic underlines the importance of analyzing different economic indicators together to gauge their collective influence on currency trends.

Case Studies of Currency Responses to Economic Indicators

To illustrate the interplay of economic indicators and their influence on currency values, this section provides case studies of currency responses to economic data. For instance, in response to high GDP growth rates, the US dollar may strengthen as investor confidence increases. On the other hand, if jobs data comes out negative, the dollar might depreciate due to diminished economic prospects. These examples underline the multifaceted impact of economic indicators and the importance of comprehensive analysis in forex trading.

Stay Ahead with a Proactive Outlook towards Economic Indicators

Instead of a reactive approach to economic indicators, *proactive anticipation* of data releases can provide traders an edge. For example, careful analysis of upcoming GDP data can help traders anticipate potential currency movements. This proactive approach helps traders stay ahead of the market, allowing them to strategically position their trades before significant market shifts.

Integration of Technical Analysis with Economic Indicators

Economic indicators provide a macroeconomic overview, while technical analysis offers insights into price trends and momentum. By combining these two methods, traders can understand the bigger economic picture and micro-level trends simultaneously. This multi-dimensional analysis can help optimize trade entries and exits, thus maximizing potential profitability.

Reliable Technical Indicators for Forex Traders

This section covers reliable technical indicators that Forex traders can use along with economic indicators. These include moving averages, which help identify price trends over specific periods, and the Relative Strength Index (RSI), which signals overbought or oversold conditions. By keeping a keen eye on these technical indicators, traders can get additional confirmation of the trends signaled by economic data.

Practical Tips for Forex Traders in Reading Economic Indicators

Proactive monitoring of economic releases allows traders to position their trades ahead of major market movements. Here, the importance of the forex economic calendar is re-emphasized. By setting notifications for important data releases, traders can stay tuned to critical information that can impact their trading strategy.

Effective Use of Forex Trading Platforms

Forex trading platforms like MetaTrader offer various tools to monitor economic indicators and track forex market movements. This section provides practical tips on setting up alerts for specific economic events, using the platform’s charting features to analyze currency pairs, and leveraging the demo trading feature to practice trading strategies based on economic data.

Continuous Learning and Adaptation

Finally, with the dynamic nature of forex markets and the economy, *continuous learning and adaptation* are crucial. As conditions change, so should trading strategies. By staying updated with financial news, frequently reviewing economic indicators, and adapting strategies in line with emerging trends, traders can thrive in the ever-evolving forex market.

In the forex trading realm, a winning strategy is one that is *dynamic*, *adaptable*, and grounded in a thorough understanding of economic indicators. By integrating analysis of key economic indicators with technical analysis and practical trading strategies, traders can navigate the challenging waters of forex trading and steer their way to successful outcomes. Continuous learning, proactive planning, and nimbleness in adapting to changing market dynamics remain the bedrock of success in forex trading.